We are a specialist investment manager, focused on identifying and managing strategically located property on behalf of our investors.

Since inception in 2009 the company has acquired a portfolio of property valued in excess of £150m for its professional client base of High Net Worth and sophisticated investors.

The team has a wealth of experience in property investment, development, structuring syndicated investor schemes and funding projects.

We focus on providing secure income property investments that are underpinned by robust fundamentals and have the ability to deliver a planned ‘exit’ for investors.

We target properties with attractive alternative uses and/or have the potential to enhance value by improving the properties lease terms.

We partner experienced development managers to provide our investors with exposure to a diverse range of development funding opportunities.

Our objective is to provide our investors with a diverse range of national property investment opportunities.

We work exclusively with High Net Worth and Sophisticated investors and tailor opportunities to both market condition and investor requirements.

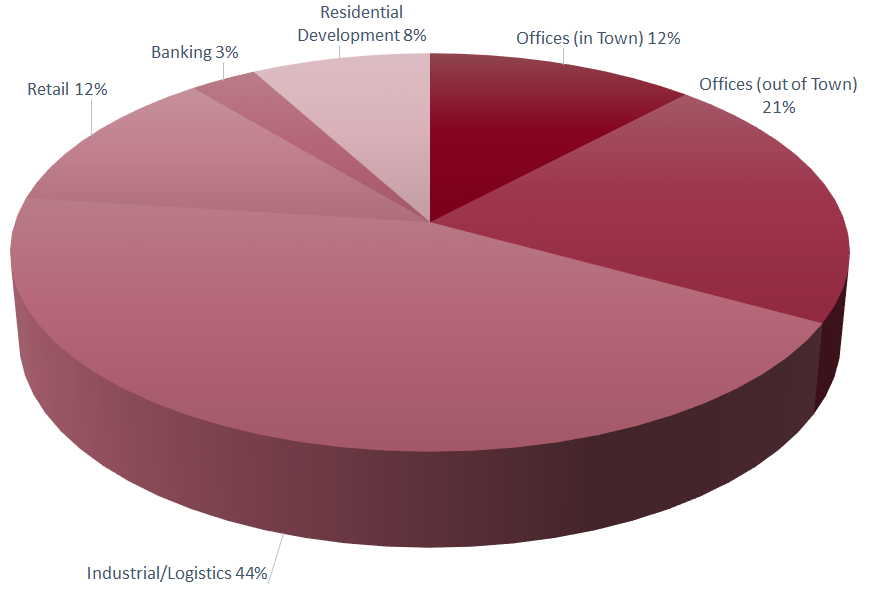

Our network of property investment advisers source opportunities nationally which has produced a diverse investor portfolio with a balanced spread of properties across a number of sectors and locations.

Our charging structure is designed to align our interests with investors. We do not charge pre-determined annual fees but instead are paid for arranging the investment and thereafter at the discretion of investors once value has been achieved.

25 Properties under management nationwide

£150m of property under management

99% of all rents collected in year ending December 2022

0.5% of the portfolio is vacant and available to let

0% of the portfolio is debt funded

7.80% average annual distributed return paid quarterly in advance

“Never test the depth of the river with both of your feet”

Warren Buffet

A bare trust is established for each property purchase. An independent professional trustee holds the legal title to the property in trust, on behalf of syndicate members. Rougemont is employed as the FCA authorised managing trustee and co-ordinates the operation of the trust property. Syndicate members are the legal beneficial owners of the property in direct proportion to the value of their respective investment. The structure allows syndicate members to sell their holding at any point. Each property is independently valued annually.

The NBD Scotland Syndicate

Purchased in December 2013, a new whisky maturation warehouse located on the M8 motorway outside Edinburgh. The property benefited from a new 15 year lease to an international distillery, with fixed rental increases and no break options. In August 2018, the syndicate opted to repay the bank borrowings by introducing additional cash resource.

Syndicate Price: £6,320,000 (valuation April 2022 £8,350,000)

Debt Funding: No borrowings

Term of Investment: Projection 15 years plus

Net Return: 8.25% pa paid quarterly in advance

Total Return on investment to date: 11.50% pa (April 2022 valuation)

The EH York Syndicate

Purchased in January 2012, a Grade 2 listed office, located within an improving central area of York. The property was subject to a lease to English Heritage expiring 2022, with a tenant only break option in 2017. A new 5 year lease extension was negotiated, expiring 2027, including an RPI linked rent review in 2022 with no break options.

Syndicate Price: £2,600,000 (valuation April 2022 £3,000,000)

Debt Funding: No borrowings

Term of Investment: Projection 10 year plus

Net Return: 9.10% pa paid quarterly in advance

Total Return on investment to date: 9.00% pa (April 2022 valuation)

The Marshalls Elland Syndicate

Purchased in November 2016, an out of town headquarters office investment, located outside Leeds and within 1 mile of the M62 motorway. The property is subject to a 25 year lease (no break options) to the D&B 5A1 covenant of Marshalls, expiring 2037. The lease benefits from fixed annual rent increases every fifth year. The property was sold in June 2021.

Syndicate Acquisition Price: £8,500,000

Syndicate Exit Price: £9,250,000

Debt Funding: 45% loan to value, fixed 5 year loan

Term of Investment: 5 years – exited June 2021

Net Return: 7.90% pa paid quarterly in advance

Total Annual Return on Investment: 9.82% pa

The Cocoa Suites Lending Syndicate

In 2018 a secured syndicated loan was provided by investor to assist with the conversion of a York city centre office building in to 34 residential apartments. All apartments were pre-sold with reservation fees paid. A first charge on the property was provided and the loan was drawn down in accordance with an independent surveyor’s certified statements.

Syndicated Loan: £2,200,000

Property value: £2,400,000

Gross Development Value: £5,000,000

Term of Loan: The loan was repaid in full after 13 months

Net Return: 8.00% pa paid quarterly in advance

Royal Mail depot, Newport, Cardiff

Purchased in March 2016 with a lease to Royal Mail expiring August 2030, subject to an RPI linked rent review in August 2020. The property is located next to the railway station and has good alternative use potential, providing underlying alternative rental growth potential.

Syndicate Price: £1,670,000 (valuation April 2022 £1,970,000)

Debt Funding: No borrowings

Term of Investment: Projection 10 year plus

Net Return: 7.25% pa paid quarterly in advance

Total Return on investment to date: 10.00% pa (April 2022 valuation)

Halifax Bank, Sheffield

Purchased in July 2012, with a 13 year lease unexpired to HBOS plc. Vacant possession was negotiated, subject to a surrender premium from HBOS plc. The property was sold in April 2020 to a UK plc restaurant, pub and bar operator after gaining planning permission for a change of use.

Syndicate Acquisition Price: £2,075,000

Syndicate Exit Price: £2,880,000

Debt Funding: None

Term of investment: 8 years – exited April 2020

Net Return: 7.00% pa paid quarterly in advance

Total Annual Return on investment: 11.25% pa

The NBD Scotland Syndicate

Purchased in December 2013, a new whisky maturation warehouse located on the M8 motorway outside Edinburgh. The property benefited from a new 15 year lease to an international distillery, with fixed rental increases and no break options. In August 2018, the syndicate opted to repay the bank borrowings by introducing additional cash resource.

Syndicate Price: £6,320,000 (valuation April 2022 £8,350,000)

Debt Funding: No borrowings

Term of Investment: Projection 15 years plus

Net Return: 8.25% pa paid quarterly in advance

Total Return on investment to date: 11.50% pa (April 2022 valuation)

The EH York Syndicate

Purchased in January 2012, a Grade 2 listed office, located within an improving central area of York. The property was subject to a lease to English Heritage expiring 2022, with a tenant only break option in 2017. A new 5 year lease extension was negotiated, expiring 2027, including an RPI linked rent review in 2022 with no break options.

Syndicate Price: £2,600,000 (valuation April 2022 £3,000,000)

Debt Funding: No borrowings

Term of Investment: Projection 10 year plus

Net Return: 9.10% pa paid quarterly in advance

Total Return on investment to date: 9.00% pa (April 2022 valuation)

The Marshalls Elland Syndicate

Purchased in November 2016, an out of town headquarters office investment, located outside Leeds and within 1 mile of the M62 motorway. The property is subject to a 25 year lease (no break options) to the D&B 5A1 covenant of Marshalls, expiring 2037. The lease benefits from fixed annual rent increases every fifth year. The property was sold in June 2021.

Syndicate Acquisition Price: £8,500,000

Syndicate Exit Price: £9,250,000

Debt Funding: 45% loan to value, fixed 5 year loan

Term of Investment: 5 years – exited June 2021

Net Return: 7.90% pa paid quarterly in advance

Total Annual Return on Investment: 9.82% pa

The Cocoa Suites Lending Syndicate

In 2018 a secured syndicated loan was provided by investor to assist with the conversion of a York city centre office building in to 34 residential apartments. All apartments were pre-sold with reservation fees paid. A first charge on the property was provided and the loan was drawn down in accordance with an independent surveyor’s certified statements.

Syndicated Loan: £2,200,000

Property value: £2,400,000

Gross Development Value: £5,000,000

Term of Loan: The loan was repaid in full after 13 months

Net Return: 8.00% pa paid quarterly in advance

Royal Mail depot, Newport, Cardiff

Purchased in March 2016 with a lease to Royal Mail expiring August 2030, subject to an RPI linked rent review in August 2020. The property is located next to the railway station and has good alternative use potential, providing underlying alternative rental growth potential.

Syndicate Price: £1,670,000 (valuation April 2022 £1,970,000)

Debt Funding: No borrowings

Term of Investment: Projection 10 year plus

Net Return: 7.25% pa paid quarterly in advance

Total Return on investment to date: 10.00% pa (April 2022 valuation)

Halifax Bank, Sheffield

Purchased in July 2012, with a 13 year lease unexpired to HBOS plc. Vacant possession was negotiated, subject to a surrender premium from HBOS plc. The property was sold in April 2020 to a UK plc restaurant, pub and bar operator after gaining planning permission for a change of use.

Syndicate Acquisition Price: £2,075,000

Syndicate Exit Price: £2,880,000

Debt Funding: None

Term of investment: 8 years – exited April 2020

Net Return: 7.00% pa paid quarterly in advance

Total Annual Return on investment: 11.25% pa

Jan Fletcher, OBE, MBA, Hons DLITT

Chairman

Jan is one of the UK’s leading entrepreneurs. She has successfully owned and operated a wide range of businesses and currently holds chairman and director roles in sectors as diverse as property investment and development, natural health products, wealth management and online publishing.

Jan has a strong track record of helping to steer growth, developing investment strategies, overseeing M&A activity and structuring corporate governance. She was awarded an OBE for Services to Industry in 1997, named Veuve Clicquot British Business Woman of the Year in 1994 and Yorkshire woman of the year in 1995. She was also an appointed Government advisor as a member of The U.K. Secretary of State for Business Entrepreneur’s Forum (BIS) in 2010.

View MoreJames Craven MRICS

Managing Director

During the last twenty years James has been responsible for successfully establishing and managing over 60 syndicated investment schemes with a combined value in excess of £300 million.

James has demonstrated a proven track record of delivering successful investment opportunities in varied market conditions and has firmly established a reputation as one of the UK’s leading experts on commercial property syndication.

View MoreNeil Smillie

Director

Neil brings strategic and financial expertise to the board of Directors.

He has held chief executive, financial director and non-executive director roles in: commercial and residential property development, commercial property investment, financial services and motor retailing. Neil is an approved ‘Controlled Person’ with the Financial Conduct Authority.

View MoreLynsey Underwood MRICS

Investment Manager

Lynsey joined Rougemont in September 2019 as Investment Manager and assists in sourcing new investment opportunities, as well as managing the existing portfolio for our investors.

View More