1st December 2014

Commercial property investment continues to be a safe bet

Welcome to the first Investment Insight from Rougemont Estates. Through these updates we aim to provide an overview of the property investment market, pulling together data and research from a range of leading organisations and sharing our insights. Please note that this information collated and illustrated does not constitute investment advice and the views expressed are purely those of the Directors of Rougemont Estates.

Welcome to the first Investment Insight from Rougemont Estates. Through these updates we aim to provide an overview of the property investment market, pulling together data and research from a range of leading organisations and sharing our insights. Please note that this information collated and illustrated does not constitute investment advice and the views expressed are purely those of the Directors of Rougemont Estates.

These regular updates aim to help you develop your own strategy for investment and will deliver clear independent research on what you can expect from the commercial property market in the months ahead.

Throughout this Insight document we have provide URL links to the source of our commentary.

Investor appetite growing

Our first look at the commercial property investment market is all good news. This year has been about recovery from a long and painful recession and investors have flooded back into the market, looking to cash in on quality assets that deliver substantial yields.

Our first look at the commercial property investment market is all good news. This year has been about recovery from a long and painful recession and investors have flooded back into the market, looking to cash in on quality assets that deliver substantial yields.

Knight Frank’s latest market update shows the total investment volume for 2014 hit £3.1bn by the end of Q3 – the highest total for six years. That insatiable investor appetite is being fuelled by a strengthening economy and a strong outlook that is helping to boost the optimism of business leaders across the country.

The huge pool of capital from overseas investors and major funds here in the UK shows no signs of subsiding and the only thing holding back the avalanche of cash is the dwindling supply of quality stock.

2014 has seen all of these funds looking to the regions for quality deals and that, coupled with businesses returning to expansion mode, is delivering strong rental growth and the tightening of occupier rental incentives – all good news for existing landlords.

Property yields are stable

Dwindling supply has seen yields continuing to fall over the summer and hence prices rise. Cushman and Wakefield’s latest research shows that prime is down 7bp to 5.1% and secondary is down 17bp to 7.8%. However, gilt yields have also fallen in the past quarter meaning property’s advantage over bonds has edged up once more, ensuring commercial property investment continues to be one of the most attractive options for investors.

Savills research shows that yields are stable, meaning we are close to the bottom of the yield cycle, and yields will remain close to the historic lows into 2015. The same research shows that the all property return for 2015 will be 12%.

Couple this with the recent volatility in the equity markets, it is understandable that property continues to be a realistic and popular choice for investors.

Alternative investments

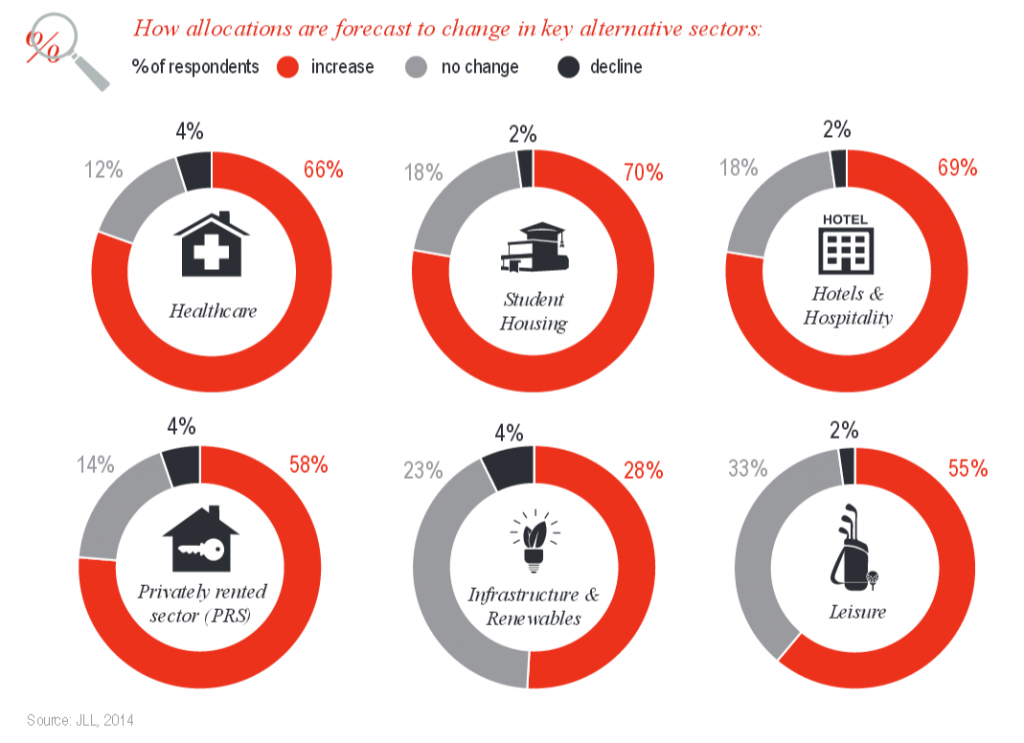

The appetite for quality stock has once again started to see the return of speculative development in almost every region of the UK, but the majority of these new developments will take two years to complete. What that means is investors are now turning to secondary markets or alternative property investments like healthcare, hotels and renewables.

JLL’s alternative property survey revealed that 90% of investors are planning to increase their exposure to alternative property sectors, while 9% will increase their allocation for alternative investments from 23% to 32% over the next five years.

JLL’s alternative property survey revealed that 90% of investors are planning to increase their exposure to alternative property sectors, while 9% will increase their allocation for alternative investments from 23% to 32% over the next five years.

What this means is investors will have to work harder to find solid returns and many are looking to the regions where they hope to find well-located stock with the potential for active asset management.

At Rougemont we minimise risk by buying properties in prime locations that benefit from long leases or offer strong prospects for lease renegotiation, rental growth or conversion to an alternative use. This strategy continues to deliver average annual income returns of 6.5-7 per cent, plus all the potential for capital growth. In 2015 we feel there will still be areas of opportunity within the prime and secondary market where our clients will be able to benefit from acquiring quality assets that present real opportunity. However, due to an increase in competition clients may have to become more realistic on their annual return expectation in order to capitalise on secure medium term growth prospects.

Rental growth will continue

Looking ahead into 2015 we believe it will be more of the same. We will continue to see growing occupier demand and that will fuel further investment demand. Rents will continue to grow throughout the year – Savills predicts five years of rental growth. This will no doubt see an increase in investors risk profiles and we are already seeing acquisitions being undertaken that factor in considerable hope value.

While vendors may be getting a little ahead of reality in terms of pricing, the pricing in the regions should stay stable for the next six months. However, opportunities will still continue to emerge from the distressed banking sector as values improve and bank managers become increasingly under pressure to return the default loans they have been managing over the last 5 years.

Perhaps the biggest question mark for 2015 will be the General Election, but I believe it will have little impact on the commercial property investment market.

The recent Scottish Referendum failed to derail the market and, historically, elections have had little impact on investor appetite. Indeed, the stable nature of British politics has long been a draw for overseas investors.

While the liquidity of direct property ownership can sometimes be seen as a drawback, it can also be a strength. Unlike other liquid assets, property does not react quickly to opinion polls or political instability and, because our major political parties are so similar, the election will have little impact, regardless of the outcome.

Overall, competition will continue to be fierce in 2015 and I also expect to see the Institutional Funds playing a bigger role next year as investors deploy further funds in property.. The outlook is good for existing landlords and likely to be competitive for new investors but opportunities will present themselves.