9th April 2015

Commercial property investment rise continues in 2015

After a stellar 2014 that saw the recovery take hold, 2015 is already demonstrating that the property cycle is firmly under way. In the first two months of this year, transaction volumes are up 20% on last year at £6.6bn.

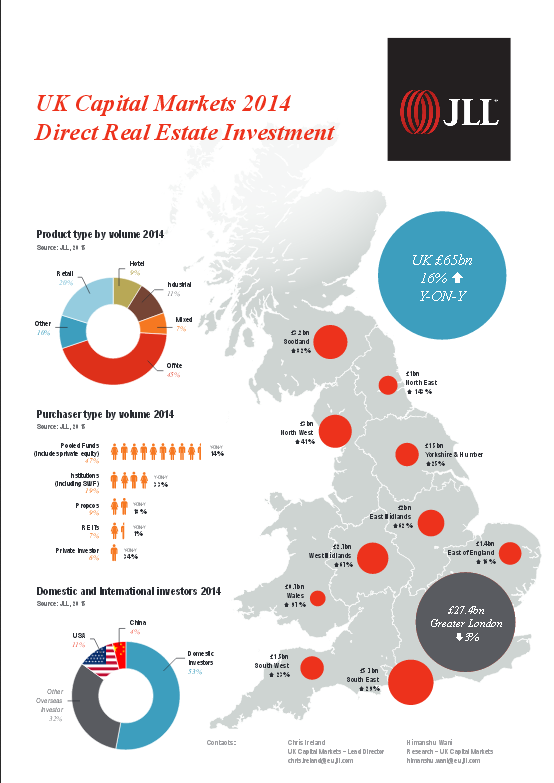

That follows a record-breaking 2014 which saw £65bn invested in property – the highest level of investment on record and 27% above the ten-year annual average. Perhaps most surprising is the fact that investment volumes are now practically double that of 2012.

Put simply, its good news for property investors and things are looking rosy for 2015. In this latest investment insight, I look at the individual sectors, where the money is coming from and what challenges investors face.

Regional investment continues to rise

Regional markets will be the top performer this year and a substantial weight of money is now looking to the UK regions for opportunities that are outperforming London and the South East.

Research from JLL shows that investment activity in the “Big Six” regions in 2014 was up 80% on the previous year and that hunger remains for 2014. That investor appetite is being fuelled by strong take-up rates and active demand currently stands at 4.2 million sq ft.

Research from JLL shows that investment activity in the “Big Six” regions in 2014 was up 80% on the previous year and that hunger remains for 2014. That investor appetite is being fuelled by strong take-up rates and active demand currently stands at 4.2 million sq ft.

The result of that is that we are now seeing prime rental growth in all of the major regional markets and speculative development is returning.

However, the continuing demand for space means that the Grade A shortage is intensifying and vacancy rates are now just 1.6%.

What that means for property investors is that good quality, well-located secondary stock is a great option and can deliver great returns. It will mean a slightly greater risk, but the right property will still attract solid tenants.

UK Capital Markets infographic FINAL (PDF)

Where is the investment cash coming from?

Overseas investors continue to dominate and account for half of all money being put into property in the UK. The USA and China dominate, accounting for 15% of all investment. Investment from America has more than doubled and Asian money is increasing at a significant rate.

The big story of 2014 was the return on the institutional investors. In 2014 these funds increased their spend on property by more than 30% year on year, further reflecting the growing confidence in the sector.

For property investors, the sheer weight of money in the market means growing competition for quality office and industrial space. Again that will help to fuel growth in the secondary market and further speculative development, but could also herald the return of the patchy retail sector?

Is retail a good investment option?

Retail remains disappointing, although there are still some great opportunities and Rougemont has just completed a retail investment that is delivering fantastic returns.

Retail remains disappointing, although there are still some great opportunities and Rougemont has just completed a retail investment that is delivering fantastic returns.

Research from Knight Frank shows retail has continued to underperform office and industrial, but argues that it is growing and presents some good opportunities.

The recession is now pretty much forgotten by the public and people are spending again. The economy looks set to continue growing and wage rises are finally materialising. All this makes for a positive outlook for retail.

For investors, this means they can be optimistic about retail but they must also be very careful of the remaining areas where recovery will be unlikely. The right retail investment is all about location – look for city centres and out-of-town parks in major regional centres – and convenience – look for car parking, food, drink and leisure.

Where should I invest my money in 2015?

Looking ahead and the General Election will be worrying some – especially as the threat of a double election continues to grow with no clear winner. However, as I’ve said before, property is a safe haven in times of political instability and will see little impact.

Offices and industrial remain a safe, albeit challenging, investment option. Both are seeing strong take-up and rental growth and are also seeing the return of speculative development – further evidence of a healthy outlook. However, that means investors have to work much harder to find quality assets.

In retail, it remains challenging but there are good quality options for the careful investor who seeks out prime locations. For the foolhardy, there are still retail ghost towns which will offer little in the way of returns. Be careful and seek expert advice if you are considering retail.

In retail, it remains challenging but there are good quality options for the careful investor who seeks out prime locations. For the foolhardy, there are still retail ghost towns which will offer little in the way of returns. Be careful and seek expert advice if you are considering retail.

Overall, property in 2015 will at least match the figures seen in 2014 and that is good news for investors. Now, if we can just get past the political merry-go-round…